eDeal - Treasury Management Solution

A centralized front-to-back-office solution with straight through processing for cash, liquidity support and risk management

MicroMac’s eDeal is an integrated treasury solution addressing the complete treasury management requirements of banks. eDeal covers a wide range of products including foreign exchange, money market, government securities (bills & bonds), etc. and entire lifecycle of deal. It addresses the functionalities across the front office, mid office and back office of the treasury.

eDeal offers an end-to-end investment management and transaction processing system right from pre-deal analytics, order management, deal capture, position management, valuation, bank account management, reconciliation, etc. The solution also has a powerful risk management module for maintaining limits and exposures tracking for regulatory and internal compliance.

Key Benefits

- Extensive Instrument Coverage: Extensive instrument coverage across Foreign Exchange and Money Markets.

- Efficient Front-Mid-Back Office Processing: eDeal provides a centralized front-mid-back office solution with straight-through processing (STP) for cash, liquidity support and risk management.

- Improved Risk Management: A complete and accurate view of risk exposure improves risk management. Real-time limit management improves audit and compliance and counterparty risk.

- Reduced Operational Costs: eDeal covers all aspects of deal processing, including every workflow step from front to back office. The objective is to minimize expensive manual operations wherever possible and reduce the amount of human error through introducing automation.

- Lower Level of IT Investment & TCO (Total Cost of Ownership): eDeal has a simple and fast interface to integrate with any other system used by bank. eDeal allows users, belonging to different legal entities to work on a single system and database, with support for cross – entity consolidation of risk and standing data. This significantly lowers implementation costs and enables ease of centralized reporting for the bank.

- Fast & Clear Reporting: eDeal contains embedded reporting and analysis tools that generate accurate reports based on confirmed deals. Bank treasury operations and those on behalf of clients may be analyzed by almost any variable within eDeal, giving a complete view of treasury positions for compliance, performance and risk purposes.

Traders Happiness

Flexible Deal Entry Platform

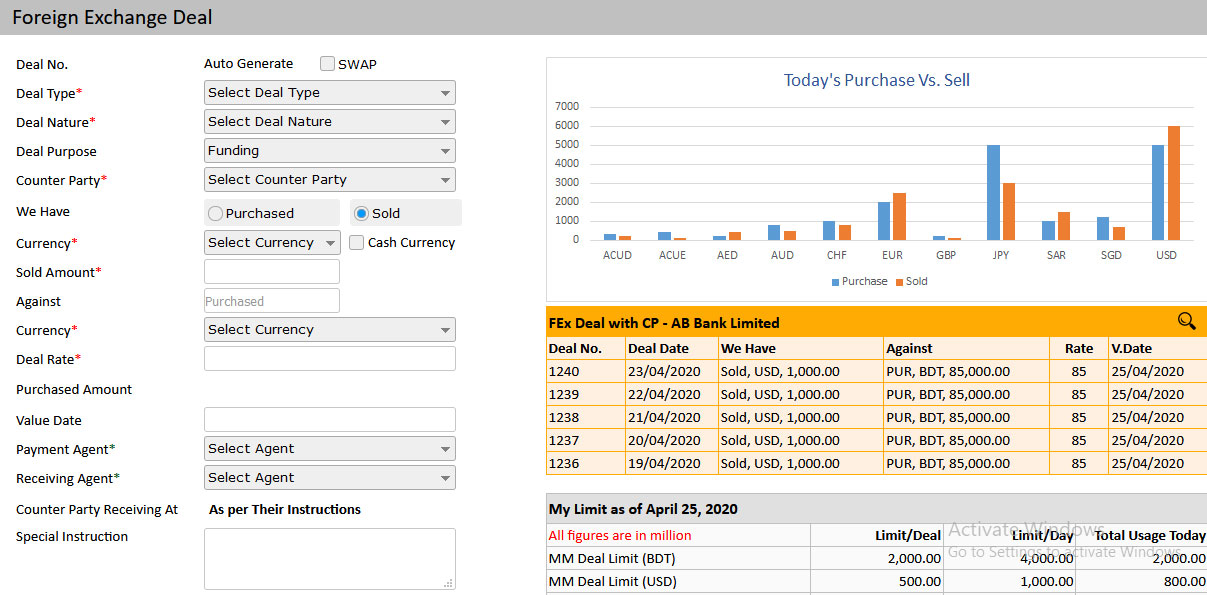

eDeal fully supports a wide breath of instruments and provides a highly intuitive user interface ensuring trade capture is an effortless activity with all blotters, positions, limits and other information displays updated in real-time.

Dynamic Dashboard

Dealers can monitor deals and positions in real-time through highly configurable blotters. eDeal has separate blotters for Foreign Exchange and Money Market.

Simulation and Scenario Analysis

eDeal enables dealers to simulate and run scenarios and observe its effect on the underlying portfolio. This flexible scenario based analysis helps define risk provision and timely and accurate decision making.

Limit Monitoring

Limits can be checked prior to trade entry. Pre settlement, settlement, counterparty, intra-day, overnight and gap limits are supported to help manage treasury risk effectively.

Operations

Overview

Straight Through Processing

Deal Lifecycle

Operational Control

Exception Management

Static Data

Accounting

Dashboard and Blotters

Reporting

Key Modules of eDeal

Foreign Exchange Module

Support for foreign exchange includes FX Cash, FX Tom, FX Spot, FX Forward, FX Option and FX Swap. Risk for FX transaction can be decomposed by BDT for easier management of positions.

Money Market Module

The money market module supports overnight (O/N) Lending, O/N Borrowing, Term Lending, Term Borrowing, OBU Lending and OBU Borrowing. Through this module amortization schedule can be managed, floating rates calculated and capitalized interest payments can be initiated.

Government Security Module

This module covers Treasury Bills, Treasury Bonds, REPO and Reverse REPO. Through this module treasury bills and bonds calculator, interest accruals, revaluation and amortization can be managed.

Limit Management Module

Counterparty and dealer limits can be entered and tracked in the system. Limits can be checked prior to trade entry to help manage treasury risk effectively. Dealers can request temporary, time based limit enhancements which need to be approved by designated middle office users.

Counter Party Module

eDeal maintains counter party database, Standard Settlement Instructions (SSI) and bank accounts. SSIs are applied to deals entered into the system to automatically generate specific payment instructions. It is important that the corporate counter party’s bank accounts are entered correctly for the settlements to be processed properly.

User Module

Besides creating profile for user option is available to set privilege. Roles, a way of assigning specific permissions to a group, allow fine-tuning the security and administration of eDeal. Users access only the data and functions they are permitted to.

Transaction Processing Module

Actual accounting entries will be passed away to the core software. eDeal has options to generate handoff files of entries that can be uploaded in the core system.

Reporting Module

eDeal’s reporting tools are ranked among the most intuitive and easy to use in the industry.

Screenshots

Clients

Testimonials